The global shift towards sustainability and net-zero emissions has made hydrogen a focal point of clean energy discussions. Australia stands at the threshold of this transformation, with the recently introduced National Hydrogen Strategy that seeks to position the country as a key player in the low-emissions technology arena. This comprehensive plan, unveiled by Federal Climate Change and Energy Minister Chris Bowen, aims not only to bolster national production of green hydrogen but also to lay the groundwork for ambitious investments and international partnerships. While the strategy showcases an evolution from earlier efforts, it invites scrutiny regarding its implementation and feasibility.

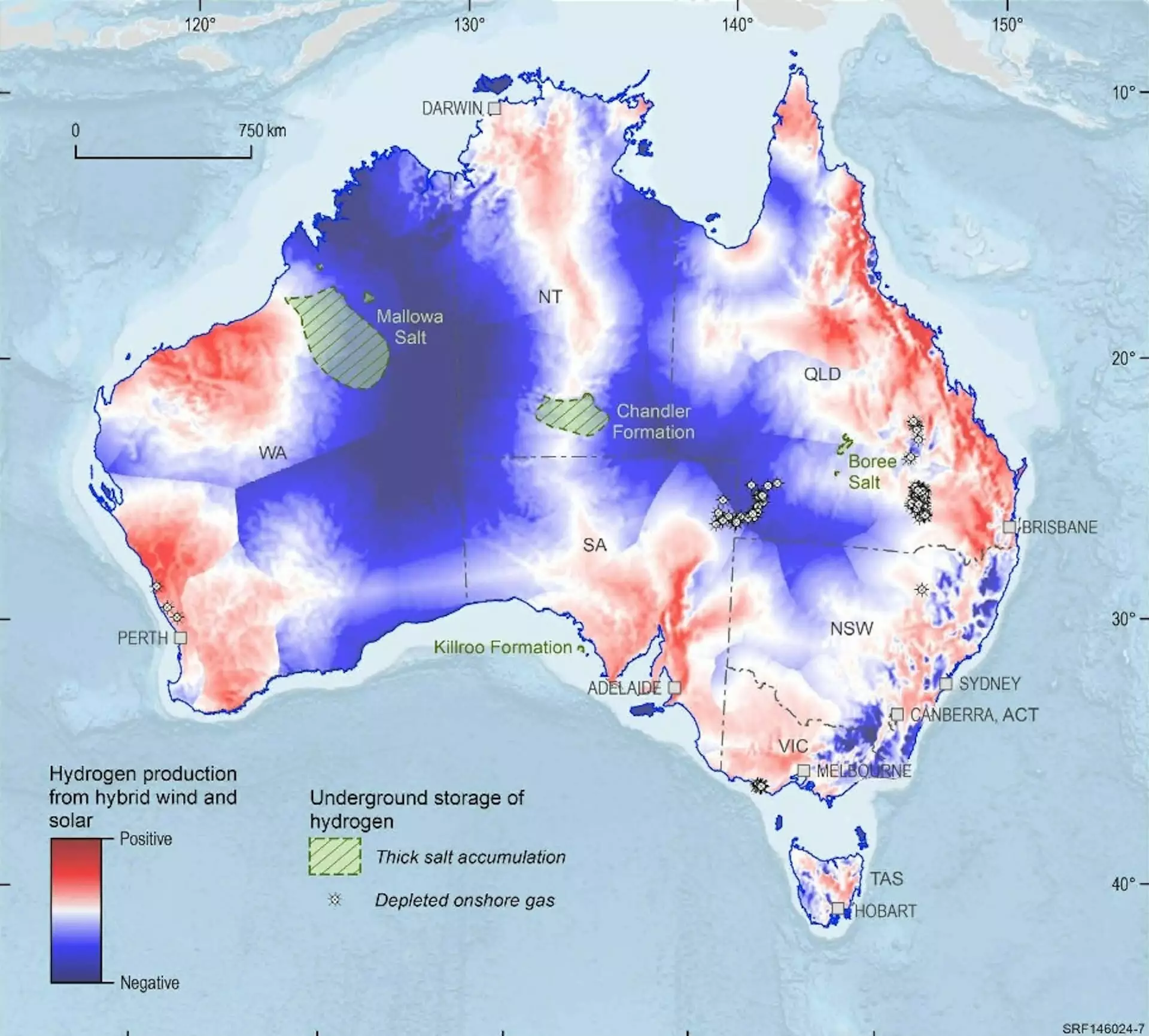

Australia’s potential for producing green hydrogen is immense, primarily due to its abundant renewable energy resources. Unlike conventional hydrogen production methods that are linked to fossil fuels and generate significant greenhouse gas emissions, green hydrogen utilizes renewable energy to extract hydrogen from water, resulting in a zero-emissions product. According to the new strategy, Australia aims to produce 500,000 metric tons of green hydrogen per year by 2030, escalating to an aggressive target of 15 million metric tons by 2050. Stretch targets further push this ambition, setting sights on 1.5 million tons and 30 million tons for the same respective deadlines.

However, these lofty objectives raise essential questions about the underlying economic viability. The current cost structure for green hydrogen production exceeds what most market participants are prepared to pay, necessitating an aggressive scaling up of production capabilities to make the transition economically feasible. This financial predicament points to the crucial role of governmental policy in shaping the future landscape of hydrogen production in Australia.

While the strategy lays out concrete production targets, it does not provide clarity on critical issues that could significantly impact investment in the sector. One critical concern is the integration of this hydrogen strategy with existing policies and technologies. There is anxiety about whether government funds will be allocated to projects that lack a solid foundation or are destined to fail. Without transparent criteria for funding allocations and project viability assessments, the future of hydrogen production could become a gamble for investors.

Moreover, the strategy suggests promising industries for hydrogen application, such as iron, alumina, and ammonia; however, its approach to prioritizing sectors and ensuring efficient resource allocation remains ambiguous. There is speculation about whether specific industries will be given preferential access to funding and infrastructure assistance. Additionally, insights into the government’s willingness to withdraw support from less competitive projects seem vague, potentially creating an environment of uncertainty for investors looking for a reliable space in which to invest.

The 2019 strategy concentrated on exporting liquid hydrogen to markets in Japan and South Korea, signaling a significant pivot in the current strategy towards Europe. Collaborations are already underway; for instance, a proposed A$660 million deal with Germany seeks to establish a framework for reliably supplying European markets with Australian green hydrogen. Nevertheless, this export ambition is fraught with logistical complications, notably the high costs and challenges involved in the transport of hydrogen.

Industry experts advocate focusing on domestic applications, particularly in the production of green iron, as a potent avenue for establishing a sustainable hydrogen industry in Australia. By capitalizing on hydrogen’s utility in domestic manufacturing, Australia can ensure job creation and boost its regional economies while maintaining a competitive edge in global markets.

Safety concerns surrounding hydrogen, derived from its volatile nature, remain a pivotal issue. The previous strategy acknowledged the need for community acceptance by highlighting safety protocols and environmental stewardship. Conversely, the new strategy shifts focus towards community benefits, prioritizing job creation and stakeholder consultations, particularly with First Nations peoples. There’s a growing recognition of the need for inclusive discussions about the potential socio-economic impacts of hydrogen projects.

However, achieving a genuine assessment of community benefits will require concrete measures beyond mere acknowledgment. In order to maintain public trust and support, it’s imperative that the Australian government ensures transparent, ongoing communication around safety, environmental impacts, and particularly, water management processes associated with hydrogen production.

The 2029 review proposed in the new hydrogen strategy is crucial for addressing evolving market dynamics and technological advancements. The indicators of success will include attracting financing for large-scale hydrogen projects, signing long-term contracts with users, and fostering sustainable partnerships in renewable energy sources to support hydrogen production.

Ultimately, if Australia fails to realize these indicators within the next decade, fundamental re-evaluations of its hydrogen strategy may be necessary. Maintaining a forward-looking approach, Australia must continue to adapt its strategies based on performance and investor confidence while adhering to its ambitious climate commitments in a rapidly shifting global energy landscape.

Leave a Reply