In recent years, the term “carbon neutrality” has become a marketing buzzword, embraced by numerous corporations seeking to enhance their environmental image while continuing business as usual. However, a critical examination reveals that many of these claims may be misleading. A study published in Nature Communications by researchers from Kyoto University uncovers troubling truths about companies’ reliance on the voluntary carbon market (VCM) for their offsetting practices. Surprisingly, the majority of carbon credits being utilized are of questionable quality, calling into question the very integrity of these corporate claims.

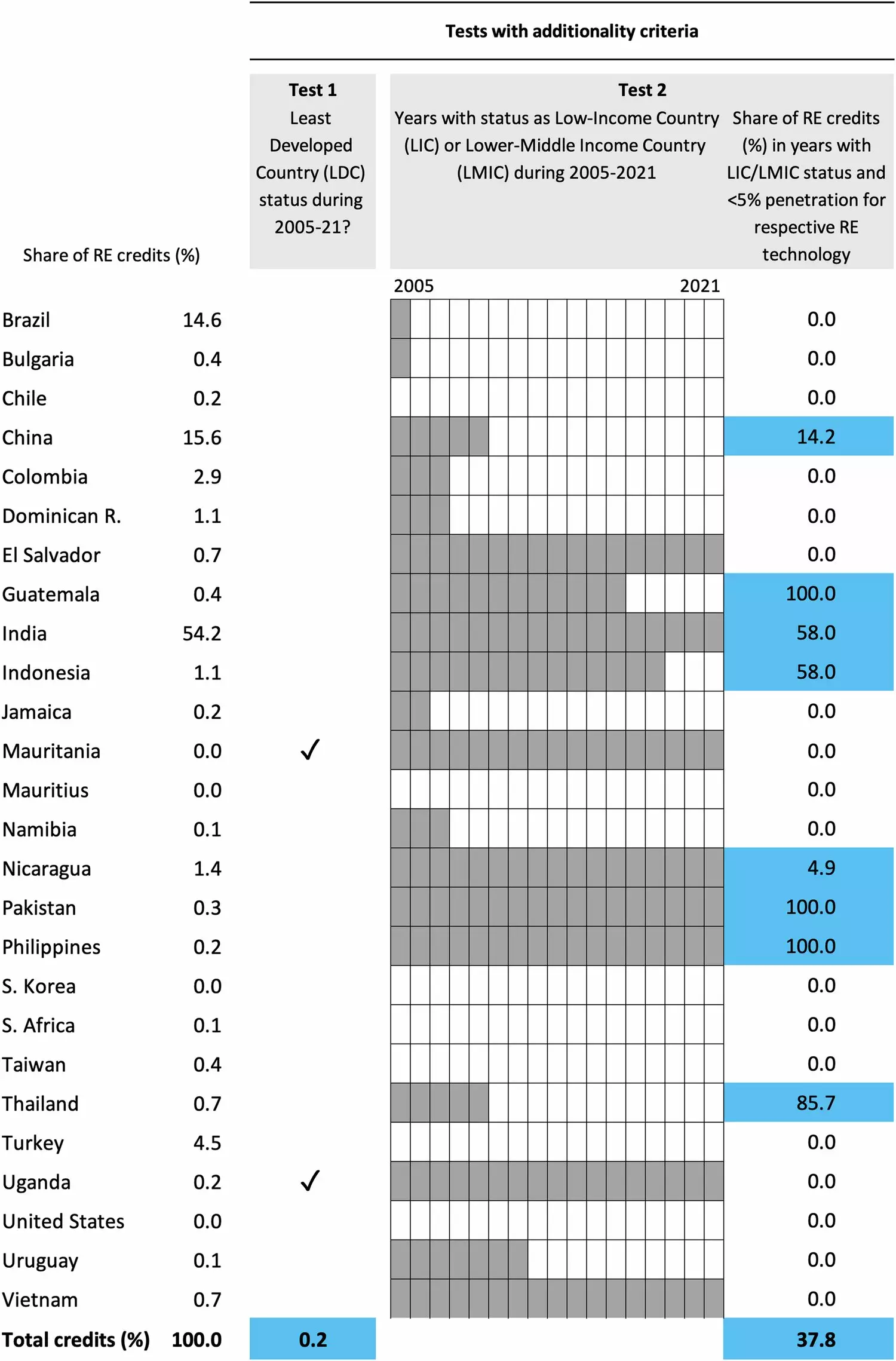

The study scrutinized the top 20 entities responsible for retiring the largest number of carbon offsets in the VCM over the past four years. Notably, these include well-known oil companies, airlines, automotive giants, and logistics firms, all of which contributed to over 20% of the total credits retired globally. The alarming finding is that none of these corporations managed to substantiate that a significant portion of their carbon offsets adhered to recognized quality standards. Many of their purchases primarily consisted of cost-effective credits from projects initiated a decade or more ago — a strategy that appears to prioritize financial savings over genuine climate action.

This reliance on inexpensive, aged offsets raises further concerns about the efficacy of their climate commitments. According to lead author Gregory Trencher, the widespread pursuit of cheap offsets indicates a troubling trend where companies may be more focused on bolstering their public relations than catalyzing real change within their operations.

The ramifications of these findings extend beyond corporate greenhouse gas emissions; they also reflect a deeper issue of accountability within the climate action landscape. The fact that nearly all of the 20 companies have established net-zero targets complicates the narrative. While companies promote themselves as “climate neutral,” their failure to invest in high-quality offsets suggests a systemic practice of greenwashing. Essentially, firms seem to be leveraging ineffective carbon offset strategies as a substitute for meaningful emissions reduction efforts.

Trencher emphasizes that the issues with carbon offset quality originate from both the supply of credits and the demand side. It is not only the projects’ effectiveness at achieving genuine emissions reductions that is in question, but also the choices that corporations make in their purchasing decisions. By opting for cheaper alternatives, companies risk perpetuating a misleading narrative about sustainability without contributing to the crucial investments required to address climate change effectively.

In light of these revelations, the urgent need for more robust governmental policies becomes evident. Offsetting practices available on the VCM should not be regarded as an adequate replacement for substantial regulatory frameworks that demand real changes in emissions sources. The reliance on unreliable carbon credits may serve as a temporary solution for corporations but ultimately detracts from the urgent changes required in energy technologies and supply chains.

As businesses grapple with the transition toward sustainability, discerning between legitimate environmental action and superficial commitments is more important than ever. To truly contribute to mitigating the impacts of climate change, corporations must prioritize transparent, high-quality carbon offsets and invest in sustainable innovations that drive long-term environmental progress rather than rely on the convenient guise of carbon neutrality.

Leave a Reply